Top 10 Blockchain Networks by Activity in 2025: The Chains Driving Web3 Forward

Top 10 Blockchain Networks : Blockchain network activity is one of the clearest indicators of adoption, ecosystem health, and where user attention is heading. In 2025, the story isn’t about one blockchain dominating—it’s a multi-chain reality. From high-throughput Layer 1s like Solana to Ethereum’s Layer 2 rollups, activity data reveals how the Web3 landscape is diversifying.

This list of the Top 10 Blockchain Networks is based on a combination of metrics: daily and monthly transactions, DeFi Total Value Locked (TVL), NFT trading volumes, and the number of active decentralized applications (dApps). Sources include DappRadar’s June 2025 data and independent market reports.

1. BNB Smart Chain – 11.49M Transactions

Source: The Block

BNB Smart Chain (BSC) continues to lead in raw transaction counts thanks to its low fees, EVM compatibility, and massive retail user base. With over 5,800 dApps and more than a million deployed smart contracts, its ecosystem is both mature and accessible.

BSC’s DeFi presence is significant with $6.82B TVL, supported by popular protocols in yield farming, token swaps, and GameFi. The tight integration with Binance’s exchange infrastructure ensures a steady inflow of users, particularly from retail and emerging markets where low-cost transactions matter most.

2. Solana – 10.89M Transactions

Source: The Block

Solana has solidified its position as a high-performance Layer 1, boasting sub-second block times and negligible fees. The network’s $4.04B in DeFi TVL is complemented by one of the most active NFT markets in the industry.

Its appeal extends beyond finance—gaming projects thrive here, leveraging Solana’s scalability. Developer incentives and a growing number of enterprise-grade projects are further expanding its footprint.

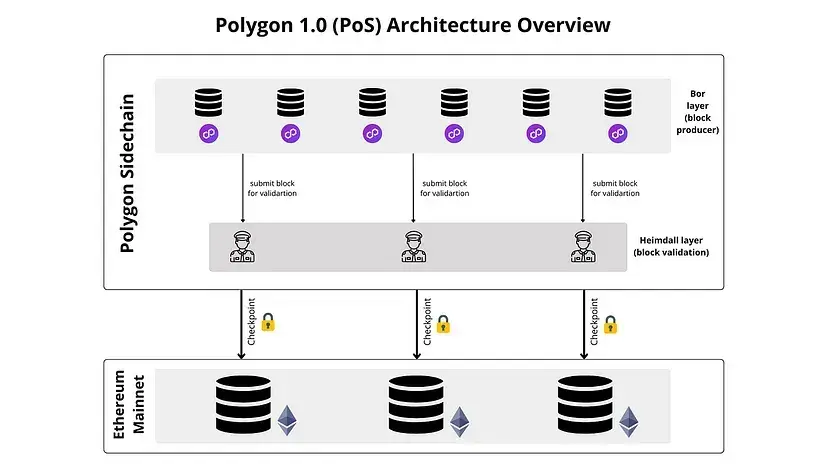

3. Polygon (PoS) – 4.46M Transactions

Source: QuilAudits

Polygon remains a vital scalability solution for Ethereum, blending low-cost transactions with EVM compatibility. Its $1.29B TVL and $17.28M NFT volume in June 2025 show that its ecosystem remains active across multiple fronts.

Global brand partnerships—from luxury fashion to sports franchises—are giving Polygon unique visibility outside traditional crypto circles. Its gaming and NFT sectors continue to pull in both developers and mainstream users.

4. zkSync Era – 3.54M Transactions

zkSync Era is a zk-rollup Layer 2 that delivers Ethereum-level security with faster and cheaper transactions. With $776M TVL, it’s attracting DeFi protocols and NFT projects seeking scalability without compromising decentralization.

A notable trend is the migration of Ethereum dApps to zkSync Era, drawn by its technical efficiency and strong developer support.

5. Base – 3.04M Transactions

Base, developed by Coinbase, is designed to make Web3 accessible to mainstream users. Its $1.72B TVL and rapid integration with social dApps suggest that onboarding simplicity is a winning factor.

By leveraging Coinbase’s extensive user base, Base bridges the gap between centralized exchange users and decentralized applications.

6. Linea – 2.56M Transactions

Source: SLEX

Linea, a zkEVM Layer 2 backed by ConsenSys, is still in early growth stages but shows promise. While its $32.88M TVL is modest, developer engagement is accelerating.

With Ethereum compatibility and zk-rollup security, Linea is positioning itself for both DeFi and NFT innovation.

7. Optimism – 1.58M Transactions

Source: Dapp Radar

Optimism is the Layer 2 of choice for many established Ethereum DeFi protocols, boasting an impressive $8.17B TVL. Its OP Stack technology is powering multiple new rollup chains, expanding its influence beyond its own network.

Key projects include Synthetix for derivatives trading and Worldcoin for digital identity. The network’s low fees and scaling capabilities continue to attract both retail and institutional activity.

8. Ethereum – 1.43M Transactions

Source: Token Metrics

Ethereum remains the center of high-value blockchain activity, even if it processes fewer transactions than some competitors. Its $157.4B TVL dwarfs all others, and it’s home to the most valuable NFT collections despite a market cooldown.

The ongoing migration to Layer 2 solutions is strategic—Ethereum is positioning itself as a settlement layer while letting L2s handle retail transaction loads.

9. Top 10 Blockchain Networks: Arbitrum – 1.04M Transactions

Arbitrum is the leading Layer 2 by TVL at $17.2B. Known for its strong DeFi ecosystem—including GMX, Uniswap, and Radiant—it also shows potential in blockchain gaming.

The combination of high liquidity, low fees, and a developer-friendly environment cements its role in Ethereum’s scaling strategy.

10. Top 10 Blockchain Networks: Tron – 261M Transactions

Source: Coinpedia

Tron leads in transaction count for a specific reason—stablecoin transfers. As the primary network for USDT in emerging markets, Tron processes enormous payment volumes at minimal cost.

While its DeFi ecosystem is smaller than Ethereum’s or BSC’s, its role in cross-border payments and remittances is unmatched in scale.

Top 10 Blockchain Networks: Key Observations & Trends

Layer 1 vs Layer 2 – Ethereum’s mainnet dominates value, but Layer 2 networks are taking over in retail transaction counts.

Scalability Wins – Chains with low fees and high throughput like Solana, BSC, and Polygon remain leaders in activity.

NFT & Gaming Boost – Blockchains with vibrant NFT and gaming ecosystems see higher daily engagement.

Stablecoin Strength – Tron shows that payments and remittances remain powerful use cases for blockchain adoption.

Top 10 Blockchain Networks: Conclusion

The Top 10 Blockchain Networks in 2025 illustrate a diverse and specialized ecosystem. BNB Smart Chain and Solana lead in transaction volume, Ethereum and Arbitrum dominate in value locked, and niche leaders like Tron own specific verticals such as stablecoin transfers.

Looking ahead, Layer 2 solutions are set to grow even faster, but Layer 1 chains will continue to anchor payments, gaming, and DeFi innovation—ensuring the blockchain world remains multi-chain for years to come.